Content

SmartAsset Advisors, LLC (“SmartAsset”), a wholly owned subsidiary of Financial Insight Technology, is registered with the U.S. SmartAsset does not review the ongoing performance of any RIA/IAR, participate https://kelleysbookkeeping.com/ in the management of any user’s account by an RIA/IAR or provide advice regarding specific investments. After figuring out how much you take home, look at what that total is during the course of one month.

Multiply your gross monthly income amount by 12 to find out your annual gross salary. Make sure you take into account any short or long-term bonuses you might receive to land at your total gross number. It also includes other forms of income, including alimony, rental income, pension plans, interest and dividends. However, if you simply work one job and receive an annual salary from your employer, your gross income would equal your total annual salary before any taxes or benefits are taken from your paycheck. Net income is gross profit minus all other expenses and costs and other income and revenue sources that are not included in gross income.

How to calculate gross income if you’re a salaried employee

She then deducts the interest on her student loan ($150), which is an above-the-line deduction, to arrive at a gross monthly income of $3,750. For example, it is possible (but not common) for a business’s gross income and net income to be the same number if the only cost of doing business is the cost of making the product sold. And in rare cases, Gross Income Vs Net Income it can be possible for net income to be greater than gross income if a business has a large amount of non-operating income, such as interest. However, in the vast majority of cases, net income is less than gross income. As an investor, looking at gross and net income is important when assessing the profitability and growth of a company.

Significantly less common for small businesses, the C corporation pays taxes directly as a business entity on Form 1120, U.S. One term the IRS does use that you might want to know when it comes to taxes and your income is adjusted gross income. Need help determining selling prices for your products in order to save money and increase profits? Gross income appears on income statements, also called profit-and-loss statements.

Banking & Insurance

Build your business by finding projects that meet your needs and creating long-term relationships with clients who can easily re-engage your services. The compensation that employees get to take home depends on a variety of payroll deductions, some of which may be voluntary, whereas others are mandatory. Before you make a plan for your budget, your business, or your investments, let’s take a closer look at these two important terms and how to calculate each and what them mean for your total net worth. However, as any business owner knows, this doesn’t mean that you put $590,000 in your pocket at the end of the year.

- As a result, banks often require a company to provide an income statement (and often a multi-year income statement) before issuing credit.

- Before calculating your subscription, we allow you to deduct reasonable practice expenses up to 50% of the gross figure.

- If you’re self-employed, you’re responsible for paying these taxes on your own, usually every quarter.

- Often, the term income is substituted for net income, yet this is not preferred due to the possible ambiguity.

You’ll want to know this number because most bills require monthly payments. MLPF&S is a registered broker-dealer, registered investment adviser, Member SIPC layer, and a wholly owned subsidiary of BofA Corp. To learn how to calculate your net income based on expenses and allowable deductions, try our calculator. Marketplace gives you access to projects at top companies who value independent talent.

Budgeting Resources

Since net income deducts all of your expenses, this net profit is almost always a smaller amount than your gross income. “Startups are understood to be unprofitable by most accounting standards because they’re reinvesting any profits back into their business,” says Asher Rogovy, chief investment officer at Magnifina. “Both of these numbers can help investors determine how risky a business investment can be,” Diels continues. For example, let’s say Joe budgets 30% of his income to cover his rent.

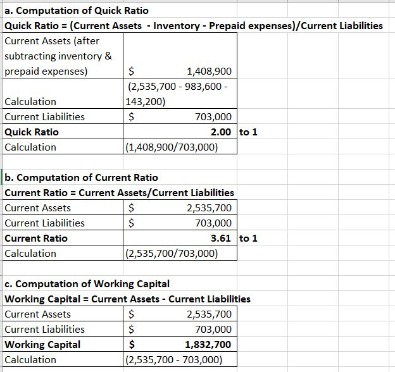

The difference between a company’s net and gross income is equal to its total expenses incurred during the covered period. Net income is the income remaining after expenses are deducted from the total revenue. In other words, net income is the amount you make after factoring in all of your costs.

How to calculate net income

Your gross income, often called gross pay, is the total amount you’re paid before deductions and withholding. If you aren’t paid an annual salary, your gross pay for a paycheck will be equal to the number of hours you worked multiplied by your hourly pay rate. When you add up all your gross pay for a year, you should get your annual gross income. If you’re salaried, the annual salary your employer pays you is the same as your annual gross income. The net income is a business or individual’s gross income minus any withholdings, business expenses, or other costs. For example, if a business has a gross income of $3 million but pays $1 million in wages and benefits, $250,000 in rent, and $250,000 in taxes, it would have a net income of $1.5 million.

- Gross and net income are two terms you’ll commonly see in reference to your personal finances, a business’s finances and sometimes your taxes.

- The company also posted $55.3 billion in net income for the same period, a decrease of 7% from the previous year.

- LegalZoom provides access to independent attorneys and self-service tools.

- Lenders and financial institutions use net income information to assess a company’s creditworthiness and to make lending decisions.

Other expenses that are not directly related to the specific product or service, such as overhead costs including rent, utility bills, and administrative bills, should not be deducted. To calculate net income, you take gross income and subtract taxes and expenses, and include depreciation and amortization as well. When you’re paid an annual salary, you’ll often see a recurring figure on every payslip, showing your gross pay for that month.

About Our Taxes Expert

Here are a couple of different situations where you may use the term “net income” in your business. Of course, the offers on our platform don’t represent all financial products out there, but our goal is to show you as many great options as we can. Sign up for Shopify’s free trial to access all of the tools and services you need to start, run, and grow your business. See what’s making money for your business with apps that calculate profit in real time. The widget company’s net income margin is 20%—$10 million of net income divided by $50 million of revenue.

That $250,000, before any expenses are deducted, is equal to the store’s gross income for that quarter. These two metrics can be used to evaluate which companies you want to invest with and can offer you a nuanced look at your own personal finances. Rogovy also suggests looking at net income for established companies as the primary goal is to pay dividends for shareholders, which are determined from net income. Multiple jobs, one-time financial gains such as inheritances or contest winnings, or income-generating real estate and investments can complicate the math—and the tax implications—considerably.